[divider] [/divider] [divider] [/divider]

Regional assets recover ground after initial negative reaction to Brexit vote

REGIONAL MACROECONOMIC DEVELOPMENTS & OUTLOOK

- Brexit is a net growth and market sentiment negative but not a catastrophic event for the region’s prospects

- Modest direct trade and FDI ties with UK; Region more exposed to a Euroarea slowdown

- Important long-term political economy repercussions for the region

REGIONAL MARKET DEVELOPMENTS & OUTLOOK

- Investor sentiment improves after an initially negative knee-jerk reaction to the UK referendum

- Most emerging market bourses recovered ground in July, government bonds extended their uptrend, while currencies were little changed over the last month or so

- Yet, risks lie ahead

COUNTRY FOCUS

- Bulgaria: Economy on solid footing in Q2-2016

- Cyprus: Challenges and Opportunities from Brexit

- Romania: Inflation jump in June

- Serbia: Two more chapters on EU accession opened in July

SPECIAL FOCUS: BREXIT IMPACT ON THE REGION

Global risk sentiment improves after initial negative knee-jerk reaction after the UK referendum

Source: Bloomberg, Eurobank Research

Regional assets recover ground after initial negative reaction to Brexit vote

REGIONAL MACROECONOMIC DEVELOPMENTS & OUTLOOK

- Brexit is a net growth and market sentiment negative but not a catastrophic event for the region’s prospects

- Modest direct trade and FDI ties with UK; Region more exposed to a Euroarea slowdown

- Important long-term political economy repercussions for the region

REGIONAL MARKET DEVELOPMENTS & OUTLOOK

- Investor sentiment improves after an initially negative knee-jerk reaction to the UK referendum

- Most emerging market bourses recovered ground in July, government bonds extended their uptrend, while currencies were little changed over the last month or so

- Yet, risks lie ahead

COUNTRY FOCUS

- Bulgaria: Economy on solid footing in Q2-2016

- Cyprus: Challenges and Opportunities from Brexit

- Romania: Inflation jump in June

- Serbia: Two more chapters on EU accession opened in July

SPECIAL FOCUS: BREXIT IMPACT ON THE REGION

Global risk sentiment improves after initial negative knee-jerk reaction after the UK referendum

Source: Bloomberg, Eurobank Research

Ioannis Gkionis

Research Economist

Eurobank Ergasias

+30 210 3331225

igkionis@eurobank.gr

Galatia Phoka

Research Economist

Eurobank Ergasias

+30 210 3718922

gphoka@eurobank.gr

The authors wish to thank Dr. Tasos Anastasatos, Deputy Chief Economist, for his insightful comments and Mr. Grigoris Katsavos for his special contribution and excellent research assistance

Ioannis Gkionis

Research Economist

Eurobank Ergasias

+30 210 3331225

igkionis@eurobank.gr

Galatia Phoka

Research Economist

Eurobank Ergasias

+30 210 3718922

gphoka@eurobank.gr

The authors wish to thank Dr. Tasos Anastasatos, Deputy Chief Economist, for his insightful comments and Mr. Grigoris Katsavos for his special contribution and excellent research assistance

Bulgaria | Cyprus | Romania | Serbia

Bulgaria | Cyprus | Romania | Serbia

DISCLAIMER

This report has been issued by Eurobank Ergasias S.A. (“Eurobank”) and may not be reproduced in any manner or provided to any other person. Each person that receives a copy by acceptance thereof represents and agrees that it will not distribute or provide it to any other person. This report is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned herein. Eurobank and others associated with it may have positions in, and may effect transactions in securities of companies mentioned herein and may also perform or seek to perform investment banking services for those companies. The investments discussed in this report may be unsuitable for investors, depending on the specific investment objectives and financial position. The information contained herein is for informative purposes only and has been obtained from sources believed to be reliable but it has not been verified by Eurobank. The opinions expressed herein may not necessarily coincide with those of any member of Eurobank. No representation or warranty (express or implied) is made as to the accuracy, completeness, correctness, timeliness or fairness of the information or opinions herein, all of which are subject to change without notice. No responsibility or liability whatsoever or howsoever arising is accepted in relation to the contents hereof by Eurobank or any of its directors, officers or employees.

Any articles, studies, comments etc. reflect solely the views of their author. Any unsigned notes are deemed to have been produced by the editorial team. Any articles, studies, comments etc. that are signed by members of the editorial team express the personal views of their author.

DISCLAIMER

This report has been issued by Eurobank Ergasias S.A. (“Eurobank”) and may not be reproduced in any manner or provided to any other person. Each person that receives a copy by acceptance thereof represents and agrees that it will not distribute or provide it to any other person. This report is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned herein. Eurobank and others associated with it may have positions in, and may effect transactions in securities of companies mentioned herein and may also perform or seek to perform investment banking services for those companies. The investments discussed in this report may be unsuitable for investors, depending on the specific investment objectives and financial position. The information contained herein is for informative purposes only and has been obtained from sources believed to be reliable but it has not been verified by Eurobank. The opinions expressed herein may not necessarily coincide with those of any member of Eurobank. No representation or warranty (express or implied) is made as to the accuracy, completeness, correctness, timeliness or fairness of the information or opinions herein, all of which are subject to change without notice. No responsibility or liability whatsoever or howsoever arising is accepted in relation to the contents hereof by Eurobank or any of its directors, officers or employees.

Any articles, studies, comments etc. reflect solely the views of their author. Any unsigned notes are deemed to have been produced by the editorial team. Any articles, studies, comments etc. that are signed by members of the editorial team express the personal views of their author.

Contents

I. Regional Macroeconomic Developments & Outlook 3

II. Regional Market Developments & Outlook 5

Trader’s view 7

III. Country Focus 9

Bulgaria (Baa2/BB+/BBB-) 9

Cyprus ((P)B3/BB-/B+) 11

Romania (Baa3/BBB-/BBB-) 13

Serbia (B1/BB-/B+) 15

Contents

I. Regional Macroeconomic Developments & Outlook 3

II. Regional Market Developments & Outlook 5

Trader’s view 7

III. Country Focus 9

Bulgaria (Baa2/BB+/BBB-) 9

Cyprus ((P)B3/BB-/B+) 11

Romania (Baa3/BBB-/BBB-) 13

Serbia (B1/BB-/B+) 15

Brexit is a net growth negative but not a catastrophic event for the region’s prospects |

|

|

The UK referendum outcome in favor of Brexit in late June has increased political and economic uncertainties The direct trade and FDI ties of the broader region with the UK are modest, while there are no significant banking sector linkages Although it appears to be among those economies highly sensitive to Brexit, Cyprus could turn it into a lasting opportunity. Serbia opened two more chapters in the EU accession process in mid-July on top of those in last December |

The last week of June and the first half of July were marked with events of paramount global and regional importance. To start with, the UK referendum outcome in favor of Brexit sent shockwaves to the international and regional financial markets initially, which were recouped at a later in the month stage, increasing political and economic uncertainties worldwide. Before the dust from Brexit-induced market turbulence completely subsided, the events of the ISIS terrorist attack in Nis-France and the failed coup attempt in Turkey served as a fresh reminder that (geo) political instability could resurface at any given point of time and that the region could be confronted with the direct or indirect consequences of global issues such as terrorism. In the aftermath of the Brexit vote, IMF trimmed once again its forecasts on world GDP growth by another 0.1 ppts to 3.1% and 3.4% in 2016 and 2017 respectively in the latest WEO in July. Thus, concerns on insistently sluggish global growth were given a fresh rise as the projected world’s GDP growth rate this year is expected to be the slowest in the post-crisis era. Our main thesis is that Brexit is a net negative from an economic growth and market sentiment standpoint, but not a catastrophic event for the region. In our view, the economic repercussions under the assumption of an orderly (and not protracted in duration) divorce from the EU are manageable. This is because the direct trade and FDI ties with the UK are modest, while there are no significant banking sector linkages. On the other hand, the broader region is significantly exposed to a Euro area slowdown due to a UK exit, given the EA’s role as a key trade partner and a major capital flow generator for the region. Furthermore, the long-term repercussions from a political economy standpoint could well prove to be far more important than the pure macroeconomic consequences. Having said that, the macroeconomic consequences are expected to start materializing beyond 2016, leaving our full projections relatively unchanged, and span over 2017-2018. At a country level, Bulgaria is expected to have registered another quarter of robust growth performance in Q2. Rising real wages, the trend of improving consumer and business sentiment, lower on an annual basis energy prices, and further gains in employment were among the principal drivers of the spending recovery. Meanwhile, the results of the ongoing asset quality review and stress test of banks, conducted as part of the ongoing banking sector reform process, are expected to be made public no later than end-August 2016. In Cyprus, the real economy continues to surprise positively. Despite their recent decline, confidence indicators remained in June close to April’s post-Lehman high while other high-frequency indicators (e.g. tourist arrivals, retail sales, unemployment) are responding equally well. Ceteris paribus, FY growth is poised to gain momentum to 2.5% in 2016 vs. 1.6% in 2015, above any recent international organizations’ forecast. Finally, Cyprus could turn the Brexit into a lasting opportunity by attracting business departing from the UK. In any case, it is imperative that the reform momentum and prudent macroeconomic policies continue in order to avoid a backtracking of the economy. Strong growth in Romania is largely driven by private consumption, is financed by an overly expansionary fiscal policy, and leads to a revival of the current account deficit. Even though the budget performance in the first five months of the year points to undershooting of the official-off consolidation track- full year target, the risk of fiscal slippage is still looming in an election year. As expected, inflation jumped to -0.7% YoY in June as a result of the phasing out of last’s year food products VAT rate cut from 24% to 9%. In Serbia, low inflationary pressures allowed NBS to deliver another 25bps rate cut to 4% for the first time since February amid internal and external environment uncertainties. Even though the formation of a stable government cabinet is still pending three months after the elections, two more chapters in the EU accession process were opened on top of those in last December. Meanwhile, the strong fiscal consolidation progress within the precautionary program prompted the IMF to revise upwards the FY GDP growth estimate at 2.5% in 2016, up from 0.7% in 2015. Ioannis Gkionis (igkionis@eurobank.gr) (+30) 210 337 1225 |

|

FIGURE 1: GDP Growth performance 2015-2017 Source: Eurostat, National Authorities, Eurobank Research |

FIGURE 2: Annual average HICP inflation 2015- 2017 Source: Eurostat, EU Spring Forecasts, Eurobank Research |

|

FIGURE 3: Investments to GDP ratios 2008 vs. 2014 Source: IMF WEO, Eurobank Research |

FIGURE 4: Energy intensity of the individual countries, 2014 Source: Eurostat, National Authorities, Eurobank Research |

|

FIGURE 5: Fiscal Balance (% of GDP, Cash basis) 2015- 2017 Source: Eurostat, National Authorities, Eurobank Research |

FIGURE 6: Annual average unemployment rates 2014-2016 Source: Eurostat, National Authorities Eurobank Research |

Regional assets recover ground as risk sentiment improves after initially negative reaction to Brexit vote |

|||||||||||||||||||||||||||||||||||||||||||||

|

Emerging Market assets rallied in July after coming under pressure in the immediate aftermath of the UK referendum Turkish assets underperform on mounting domestic political jitters Most emerging market bourses recovered ground in July CESEE currencies were little changed, while most local currency government bonds extended their uptrend over the last month or so Risks lie ahead |

The majority of Emerging Market assets rallied in July. Optimism that Central Banks around the globe will act if needed to stem a potential spillover impact from the Brexit vote, a streak of positive US data which alleviated worries over the world’s largest economy’s growth prospects and hopes about a soft landing in China overshadowed the initially negative knee-jerk reaction in response to the UK referendum in which Britain voted on June 23rd in favor of leaving the European Union. Global financial markets also reacted favorably in the aftermath of a swift replacement of the UK’s Prime Minister and the re-election of Japan’s Prime Minister Shinzo Abe, while escalating domestic political uncertainty in Turkey and a terror attach in Nice, France, seemed to exert a rather limited impact on Emerging Market assets. Reflecting the said improvement in global risk sentiment, since the end of June, sovereign emerging bond spreads over USTs on the EMBI+ index hit a 1-½-year low of 350bps. In Turkey, domestic political tensions have been mounting of late after a failed military coup attempt on July 15. Concerns about a further escalation of the current upheaval are also on the rise after news that a purge of the army, police and judiciary widened to education staff, university deans, the intelligence agency and religious authorities, while media licenses have been revoked. According to media reports, more than 50,000 people have been detained, sacked or suspended in response to the coup attempt, while the country has been declared in a state of emergency for three months. Moody’s which, along with Fitch, rates Turkey’s sovereign credit ratings in investment grade, placed the country’s ratings on review for a downgrade on worries over the medium-term impact of these latest political developments on the domestic economy. This preceded an S&P downgrade on Turkey’s sovereign credit ratings further below junk with negative outlook, leaving the door open for further similar action ahead. Along these lines, the MSCI Emerging Market index reached on July 21st its highest level in eight months just above 872 points, having bounced by 10% from a 1-month trough hit in the aftermath of the Brexit vote in late June. Most bourses in the CESEE region as well as in the economies of our focus also recovered ground in July after falling sharply in the immediate aftermath of the UK referendum. In a notable exception, the earlier uptrend in Turkish stocks was cut short after the failed coup attempt. In the first four sessions since the coup attempt, the main BIST index registered losses in excess of 12% and retreated to its lowest level since February. CESEE currencies were little changed, while most local currency government bonds extended their uptrend over the last month or so, amid increased expectations that Central Banks around the globe will pursue their accommodative policies for longer. The Turkish lira and T-bonds were the major outliers in these asset classes as well on increased domestic political jitters. In more detail, the USD/TRY bounced to a record high of 3.0955 on July 20th. Meanwhile, 2- and 10-year benchmark yields jumped by ca 90bps and 110bps, respectively over the first few days after the coup attempt. Elsewhere, Serbian paper continued to outperform its regional peers after the Central Bank took the markets aback delivering a fresh 25bps rate cut in July, with the yield of the 10% May 2022 T-Note sliding by ca 50bps since the end of June to a new record low near 5.50%. With the recent rally in emerging market assets having been staged mostly on expectations for loose Central Bank monetary policy for longer, disappointment of this view as well as several risk factors lying ahead suggest that renewed bouts of increased risk aversion may emerge later in the year. Although the prospect of Brexit would take time to materialize, investors will continue to follow closely any related developments, maintaining a cautious stance ahead. Additionally, the overall process may fan a rise in Euroscepticism throughout Europe, adding to increasing political uncertainty that could dampen business investment growth. Another source of political risk in the euro area may be identified in the face of the constitutional Italian referendum in October, which is viewed as a vote of confidence on Matteo Renzi’s leadership, while towards the end of the year focus will start centering on the French elections in Q2 2017. Developments in Turkey are also likely to remain in focus for some time, though they seem to be having a rather limited impact on other emerging market peers. In the US, economic activity data releases will remain in the forefront, as investors seek for any hints on the Fed’s future monetary policy deliberations ahead. Presidential elections take centre stage in November. Meanwhile, any indications on China’s growth prospects are also likely to be closely scrutinized by market participants. Galatia Phoka (gphoka@eurobank.gr) (+30) 210 371 8922 |

||||||||||||||||||||||||||||||||||||||||||||

|

FIGURE 7: Major world & CESEE stock markets performance (%) Source: Reuters, Bloomberg, Eurobank Research |

FIGURE 8: World & EM stock markets performance Source: Reuters, Bloomberg, Eurobank Research |

||||||||||||||||||||||||||||||||||||||||||||

|

FIGURE 9: MSCI stock indices performance (by region) Source: Reuters, Bloomberg, Eurobank Research |

FIGURE 10: CESEE FX performance Source: Reuters, Bloomberg, Eurobank Research |

||||||||||||||||||||||||||||||||||||||||||||

|

FIGURE 11: Change in CESEE government bond yields (in bps) Source: Reuters, Bloomberg, Eurobank Research |

FIGURE 12: Change in 5-Year CDS spreads (in bps) Source: Reuters, Bloomberg, Eurobank Research |

||||||||||||||||||||||||||||||||||||||||||||

|

Trader’s view |

|||||||||||||||||||||||||||||||||||||||||||||

|

We remain constructive in long EUR/RSD positions We prefer staying on the sidelines on local currency Bulgarian T-bonds Long ROMGB 2027 positions appear favorable We retain our earlier trade on domestic government bonds, which remains in the money We continue to favor our earlier long recommendation on the 2023 Eurobond |

FX Over the last month or so, the dinar has moved in line with most emerging market currencies. A steep drop was evidenced after Britain voted in favor of leaving the EU. However, after initial heavy risk-off mode, equities and high yield currencies trimmed at least half of their losses on the prevailing market view that major Central Banks around the globe will pursue for longer accommodative monetary policies. Along these lines, the EUR/RSD spiked to around 124.20 in the aftermath of the UK referendum, before swiftly pulling back shortly after, also assisted by generous National Bank of Serbia action. That said, persisting appreciation pressures due to seasonal factors on the dinar have been evident since the end of June. In this context, the NBS intervened in order to halt the EUR/RSD’s downtrend, managing to keep the pair floating above 123.00. From June 30 to July 19, the Central bank bought RSD 355mn. As mentioned in our previous Regional Economic & Market Strategy Monthly seasonal factors in the summer period bodes well for weak EUR demand, but the amount of Central Bank interventions to halt this trend heavily surpasses our expectations. At present there is little to suggest the length of time and size of further NBS interventions in order to curb significant dinar appreciation. But, we believe that the current upside momentum of the dinar will eventually prove to be temporary and may wane soon. Therefore, we remain constructive in long EUR/RSD positions.

Local rates Bulgarian local currency bonds remained well supported over the last month and so, following the strong gains on the benchmarks after the UK referendum. The curve bull flattened with the long-end declining for a maximum of 26bps against a more modest 9bps paper of shorter maturities. In view of the country’s fiscal position, we expect the auction calendar to remain empty until September. Some further improvement on the secondary market is likely on the back of excess liquidity before finally sliding into summer doldrums. With valuations appearing to be rather overstretched currently, we prefer staying on the sidelines on local currency paper. In Romanian sovereign debt markets, long ROMGB 2027 positions appear favorable. The idea is supported by the high RON liquidity in the market. This liquidity is expected to be present within the next months, the carry for those bonds being more than attractive. We are considering that the markets are still seeking high yield investments and Romania is looking good from a macroeconomic point of view.

Recent global developments are indicating that Central Banks around the global will likely continue to pursue accommodative monetary policies for longer. Along these lines, we believe that yields on Serbian debt will fall further as markets await further easing action from the BOJ, BOE and ECB eventually. Additionally, Fed rate hike expectations have been pushed backwards with already strong signals that new rate hike is unlikely to happen in 2016. Looking through Serbia’s window, servicing the debt could ease up further as the country pursues a further improvement in state finances and seeks to maintain political/geopolitical issues under control. Global tendencies are going in our favor of the local currency bonds market at the moment. Hence, we retain our earlier trade on domestic government bonds, which remains in the money.

External debt markets Bulgarian Eurobonds extended their recent rally with yields dropping between 20-40bps. The belly of the curve (i.e. the 5-7 year segment), our favorite sector, strongly rallied and left Bulgaria 23’s already trading 50bps lower since issuance. We expect some consolidation in the market but continue to favor our earlier long recommendation on the 2023 Eurobond, revising our target at 1.60% as our previous 1.90% target was recently achieved.

Vessela Boteva (VBoteva@postbank.bg) +359 (2) 8166 491 Romulus-Daniel Georgescu (romulus-daniel.georgescu@bancpost.ro) +4021 3656292 Zoran Korac (zoran.korac@eurobank.rs) +381 11 206 5821 We would also like to the Eurobank Trading Team in Athens for its most valuable comments |

||||||||||||||||||||||||||||||||||||||||||||

|

|

|

Bulgaria (Baa2/BB+/BBB-) Economy on solid footing in Q2-2016 |

|

|

Sentiment data suggest that the economy remained on solid footing in Q2-2016. Consumer prices edged higher on an annual basis in June The budget execution in the first six months of the year is heavily influenced by EU funds reimbursements of the past year . |

In contrast to the regional and EU-28 average trend, the Economic Sentiment Index (ESI) in Bulgaria improved in June, increasing by 2.5 points to 105.7, up from 103.2 in May, an inch below the multi-month high of 105.8 in last December. The improvement in the sub-components of industry, services and consumer sentiment outweighed the slight deterioration in retail trade and construction. Retail trade confidence stood in June little below its multi month peak recorded in May. Overall, the ESI Index trajectory has remained at relatively high levels in the last nine months. Retail sales are in positive territory since last November, expanding at a healthy rate (+4.7% YoY in April-May). In addition, unemployment declined to 7.3% in May, down from 7.6% in April and 10.0% a year ago. The decline of unemployment in Bulgaria is the third highest in EU-28 after Cyprus and Spain. Labor intensive industries in the areas of specialized services (Information & Communication, Logistics, and Business Services) have taken the lead in job creation from traditional industries like manufacturing, retail and wholesale trade, construction. Employment expectations have remained relatively strong throughout 1H-2016 (especially in the area or retail trade), pointing to a further tightening in the labor market. With the exception of some deceleration in industrial production dynamics, other high-frequency data suggest that the economy remained on solid footing in Q2-2016. Yet, our GDP forecast still stands at 2.6% in 2016 as we see downside risks for growth stemming primarily from lower EU funds absorption mirroring the beginning of the new multi-annual EU budgeting program period, a lower than last year’s fiscal policy impulse and rising external environment headwinds for exporters. Inflation fell by 0.1%MoM in June or -1.3% YoY, from -2.0% YoY in the prior month and vs. a market’s median forecast of -1.7% YoY. The non-foods sub-component fell by 2.2%YoY providing the highest negative contribution, primarily on the back of a 9.8%YoY decline in transport amid low world energy prices. The services sub-index dropped by 1.5%YoY, while food prices, both the largest and the most volatile component of CPI, slipped by 0.7%YoY, driven lower by declines in meat (-2.0%YoY), milk, cheese and eggs (-1.3%YoY), fruits (-2.4%YoY) and vegetables (-1.1%YoY). Looking ahead, inflation is expected to make a gradual recovery in the coming months and possibly return in positive territory in late 2016 amid improving domestic demand dynamics in tandem with the waning impact of weak global energy prices. That said, regulatory prices’ adjustment in the energy sector also pose downside risks to the inflation outlook. Τhe consolidated fiscal balance on a cash basis at the end of May ran a surplus of BGN2.8bn or 3.1% of projected GDP. This marks a significant improvement from a surplus of BGN 1.1bn or 1.3% of GDP recorded over the first five months of 2015 thanks to improved tax collection and lower expenditure. The breakdown of the data showed total revenues amounted to BGN14.9bn over the said period, accounting for 45% of the annual target. Tax revenues rose by 10.1%YoY to BGN 11.3bn corresponding to 43.6% of annual plans. Non-tax revenues also rose, amounting to BGN 1.98bn or 44.2% of FY2016 target, having advanced by 12.8% on an annual basis. On the other hand, spending (including Bulgaria’s contribution to the EU budget) came in at BGN 12.1bn or 34.7% of the annual plans having decreased by 5.1%YoY. Looking ahead, the Ministry of Finance expects a further improvement in the country’s fiscal position with preliminary data indicating a surplus of BGN 3,085.9 million (3.5% of projected GDP) as of end-June 2016. That said, lower tax receipts due to seasonal factors, a concentration of EU funds receipts in H1 2016 and higher expenditure towards the second half of the year are expected to eventually push the balance of the Consolidated Fiscal Programme to a deficit. For the whole of 2016, the government targets a consolidated (on a cash basis) deficit of -2.0% of GDP, down from a -2.9% of GDP shortfall recorded last year, a target which the latest data for the consolidated fiscal programme confirm it should be comfortably met. . Ioannis Gkionis (igkionis@eurobank.gr) (+30) 210 337 1225 Galatia Phoka (gphoka@eurobank.gr) (+30) 210 371 8922 |

|

Source: National Sources, Eurostat, IMF, Eurobank Research Source: National Sources, Eurostat, IMF, Eurobank Research |

FIGURE 13: GDP growth & Inflation 2000-2016 Source: National statistics, Ecowin Reuters, Eurobank Research |

|

FIGURE 14: CA Deficit & Net FDI inflows 2010-2016 Source: National statistics, Ecowin Reuters, Eurobank Research |

|

|

FIGURE 15: Inflation dynamics 2013-2016 Source: National statistics, Ecowin Reuters, Eurobank Research |

FIGURE 16: Fiscal deficit & Gross Public Debt 2010-2016 Source: Ministry of Finance, Eurobank Research |

|

Cyprus ((P) B1/BB-/B+) Challenges and Opportunities from Brexit |

|

|

Cyprus appears to be among those economies highly sensitive to Brexit The real economy continues to surprise positively. Despite their recent decline, confidence indicators remained in June close to April’s post-Lehman high GDP growth in Cyprus outperformed the Euroarea average for a third consecutive quarter in Q1-2016 The NPEs ratio edged down to 48.1% in April down from 48.4% in March 2016 |

Cyprus appears to be among those economies highly sensitive to Brexit, along with Ireland, Malta, Luxemburg and Belgium. UK is the second most important trade partner of Cyprus by value of transactions. Exports of goods to the UK stood at 6.9% of total goods exports in 2015 (from 9.6% in 2014) or 0.8% of GDP (from 0.7% of GDP in 2014). In addition, exports of services to the UK accounted for 20.8% of total services’ exports or 7.6% of GDP in 2014, a large fraction of which is coming from the flourishing tourism sector. On the other hand, Cyprus imports a considerable amount of goods and services from the UK, while it currently runs a bilateral trade surplus of 2.6% of GDP vis-a-vis the UK. However the relative importance of the British tourist market has declined in recent years as the island has diversified towards other markets (Russia, Germany, and Israel). Despite the perceived high degree of sensitivity, Brexit could present an opportunity for the island as well. Cyprus enjoys comparative advantages, such as full EU and euro area membership, a legal and judicial system based on the English Common Law, low corporate tax rates, the key geostrategic position of the island in the Mediterranean Sea, expertise in services facilitating international business, and quality human capital. From that point of view, Cyprus could turn the Brexit into a lasting opportunity by attracting businesses departing from the UK. The ESI Index fell further by another 1.4 points to 109.9 in June, compared to 111.3 in May, vs. a multi-month peak of 113.3 in April. With the exception of consumer sentiment and construction, which improved bouncing back to the levels recorded in March and April respectively, all other sub-components of the index deteriorated. The more pronounced decline in expectations came from services (by 6.4points), retail trade (by 5.5 points), construction (by 9.6 points) and consumer sentiment (by 4.1 points). In any case, the ESI Index stands above its long-term average. Despite the small decline in the last two months, the ESI index stands still close to its post-Lehman peak recorded in last April. The improvement recorded in the past three years – a total of 42 points since April 2013- is the highest in EU-28 in the same period. Other high-frequency indicators are also responding very well. Tourism arrivals were up by +21.9% YoY in Jan-May, while tourism revenues registered an equally impressive +18.8% YoY in Jan-March. Unemployment, a lagging indicator, is on a visible downward trend. The unemployment rate came down to 12% in May vs. 15.3% a year ago, and 17% at its peak in October 2013. Last but not least, deposits’ growth was positive on an annual basis for a seventh consecutive month in May. Driven by the rise in non-financial corporations, total deposits expanded by +3.7% YoY in May, up from +2.4% YoY in April, and +2.0% YoY in March. Sentiment improvement is one of the key drivers of the consumption rebound taking place and feeding into output growth. The second estimate of the first quarter- the fifth consecutive positive reading on both a quarterly and an annual basis- proves that the economy is finally out of the woods. On a seasonally adjusted basis, GDP growth expanded by +0.9% QoQ/+2.7%YoY in Q1-2016, compared to +0.4% QoQ/+2.8% YoY in Q4-2015, up from +0.5% QoQ/+2.3% YoY in Q3-2015 and +1% QoQ/+0.1% YoY in Q1-2015. The reading came above that of EA-19 for a third consecutive quarter. After a three year recession in 2012-2014 and a cumulative drop of 10.5% of GDP, the economy expanded by +1.6% YoY in 2015 and is expected to further gain momentum to +2.5% YoY in 2016. This forecast stands above the most recent EU Commission Spring forecast of +1.7%, as lower energy prices, strong sentiment improvement, the lagged effect from Euro depreciation, the lack of additional fiscal austerity measures and a flourishing tourism sector are expected to provide more support to consumption’s recovery and net exports. The banking system-wide NPEs ratio, a more conservative asset quality EBA methodology, which augments NPLs numbers by including restructured loans for a probation period of at least 12 months, edged down to 48.4% in March 2016 vs. 48.9% in February2016, still higher than a 45.9% recorded in December 2015, and 47.7% in December 2014. The deterioration in the ratio at this point does not mirror a further rise in the non-performing facilities but rather the ongoing deleveraging, which impacts the denominator. In addition, a large fraction of the restructured loans falls into the probation period (of at least 12-month duration) and are still classified in NPEs (41.1% in April2016). On a more positive note, according to the Central Bank data, 78% of the fixed-term loans which were restructured between 1 January 2014 and 31 March 2016 abide by the new repayment schedule agreed as part of the restructuring process. Ioannis Gkionis (igkionis@eurobank.gr) (+30) 210 337 1225 |

|

Source: National Sources, Eurostat, IMF, Eurobank Research Source: National Sources, Eurostat, IMF, Eurobank Research |

FIGURE 17: Growth performance Cyprus vs. Euroarea 2010-2016 Source: Eurostat, Eurobank Research |

|

FIGURE 18: HICP Cyprus vs. Euroarea 2010-2016 Source: Eurostat, Eurobank Research |

|

|

FIGURE 19: 10Y Government Bond Yield Source: Bloomberg, Eurobank Research |

FIGURE 20: Fiscal deficit & Gross Public Debt 2011-2016 Source: Ministry of Finance, Eurobank Research |

|

Romania (Baa3/BBB-/BBB-) Inflation jump in June |

|

|

The final estimate of the Statistical Service on Q1-2016 real GDP growth revealed a more balanced than previously announced profile of growth drivers The budget performance in the first five months of the year points to undershooting of the official target, yet the risk of fiscal slippage is looming in an election year Inflation jumped to -0.7% YoY in June as a result of the phasing out of last’s year food products’ VAT rate cut from 24% to 9% |

The final estimate on the seasonally adjusted Q1-2016 GDP reading confirmed the revised estimate of +1.6% QoQ/+4.1% YoY; in unadjusted terms the reading was +4.3% YoY. The stronger than expected print (survey: +1.1% QoQ/+3.9% YoY) compares to +1.1% QoQ/+3.9% YoY in Q4-2015, up from +1.5% QoQ/+3.6% YoY in Q3-2015 and +1.2% QoQ/+3.9% YoY in Q1-2015. Although the big picture remained the same, with domestic demand in the driver’s seat, the final estimate revealed a more balanced profile of growth drivers. The dynamics of private consumption and investments were revised downwards. Private consumption jumped by 8.3% YoY in Q1, still making a hefty contribution of 5.9pps to growth (down from 9.2% YoY and a contribution 6.6pps in the first estimate). In contrast, investments expanded by only 2.3%YoY making a very modest 0.4pps contribution to growth (down from 7.0% YoY, +1.3pps in the first estimate), which was offset by the more negative contribution of inventories (-0.8pps vs -0.4pps previously). Net exports made a lower negative contribution of -2.0pps (than -3.4pps previously) – mirroring the better performance of exports (+5.5% YoY vs. +1.2% YoY) vs. the more robust dynamics of imports (+9.7% YoY vs. +8.0% QOQ?)-which was broadly expected as domestic demand recovery is always accompanied by a recovery of imports. Concerning the short-term outlook, growth is expected to accelerate further to 4.2% in 2016, up from 3.8% in 2015. Brexit is not expected to have a heavy toll on growth; Romania, while not fully immune from the related uncertainty, has limited direct ties with the UK. Growth dynamics are driven by a private consumption spending boom, fuelled by the unwarranted pro-cyclical fiscal stimulus ahead of the parliamentary elections scheduled for late 2016. Hence, the economy is driven close to, if not above, its potential growth rate at the expense of pushing government finances off consolidation track and deteriorating the external position. The current account deterioration is one of those warning signs that macroeconomic imbalances are reemerging as a result of the expansionary policy. The current account deficit jumped to 1.6% of GDP in January-May 2016 compared to a balanced position in the same period a year ago. The consolidated government balance in cash terms recorded a negligible deficit of RON782mn or 0.1% of projected GDP in January-May 2016, down from a surplus of RON6.3bn or 0.9% of GDP in the same period of 2015. The budget recorded a deficit of RON909mn in May, down from a deficit of RON2.9bn in April. In Jan-May, total revenues were down by -2.1% YoY driven by lower VAT revenues collection (-7.9% YoY) mirroring the impact of the headline VAT rate cut by 4ppts effective from January1st. Higher income tax (+11.3% YoY), excises (+7.4% YoY) and social security contributions (+6.1% YoY) helped to partially offset the decline. The collapse of EU funds inflows (down by 85.2% YoY to RON 441.6mn in Jan-May) as a result of the closing of the previous program period weighted further negatively. On the other hand, total expenditure spiked by +5.9% YoY in January-May 2016. Staff costs were up by +9.8% YoY reflecting the generous wage hikes for all public sector employees and the rise of the minimum wage. Pension expenses were also up by +7.6% YoY in the same period. Overall, the risks of fiscal slippage in 2016-2017 have risen substantially. The overly expansionary fiscal policy threatens to push the fiscal deficit in cash terms above the 2.8% of GDP target (2.95% in ESA2010 terms) in 2016 and further above the 3% threshold in 2017. CPI came in at -0.2% MoM/-0.7% YoY in June compared to +0.3% MoM/-3.5% YoY in May, slightly below market expectations (+0.1% MoM/-0.6% YoY). The slowdown in the annual rate of decline is largely explained by the phasing out of last year’s food products’ VAT rate cut, from 24% to 9% effective from June 2015, compounded by the 4ppts headline VAT rate cut, from 24% to 20% effective from January 1st, which pushed headline inflation into negative territory over recent months. This was especially so, given the large share of the food component in the consumption basket. The volatile food component of CPI jumped to -0.7% MoM/+0.0% YoY in June vs. +0.6% MoM/-7.6% YoY in May. Non-food items remained almost flat at +0.1% MoM/-1.2% YoY in June compared to +0.1%MoM/-1.2%YoY in May. Services inched down to +0.1% MoM/-0.7% YoY in June compared to +0.1% MoM/-0.6% YoY in May. Overall, given the downbeat readings so far, the inflation trajectory has been softer than envisaged before. In the NBR’s view, inflation will stay in negative territory until July and then gradually pick up pace. The NBR baseline scenario envisages CPI gradually returning inside the variation target band (2.5% +/-1%) and standing in the upper half of the band at the end of the forecast horizon in Q4-2017. As a result, NBR slashed its 2016 year end inflation forecast to +0.6% YoY vs. +1.4% YoY in the February inflation report compared to +1.0% YoY in that of November. NBR Governor Mugur Isarescu explained in a recent press conference that the transitory effects of the headline VAT rate cut and of other indirect tax cuts as well as the announced reduction of several administrative prices in energy were the main reasons behind the revision. Ioannis Gkionis (igkionis@eurobank.gr) (+30) 210 333 71225 |

|

Source: National Authorities, EC, IMF, Eurobank Research Source: National Authorities, EC, IMF, Eurobank Research |

FIGURE 21: Growth performance Romania vs. EU28 2010-2016 Source: Eurostat, Eurobank Research |

|

FIGURE 22: Sentiment indicators 2011-2016 Source: Eurostat, Ecowin Reuters, Eurobank Research |

|

|

FIGURE 23: Monetary policy & FX rate 2012-2016 Source: Bloomberg, Eurobank Research |

FIGURE 24: Inflation components 2011-2016 Source: National statistics, Eurobank Research |

|

Serbia (B1/BB-/BB-) Two more chapters on EU accession opened in July |

|

|

Chapter 23 (Judiciary & fundamental rights) and Chapter 24 (freedom & security) open in Serbia’s EU accession path A new government after April’s general elections has yet to be formed Most recent macroeconomic data suggest that the economy remains in good shape The MPC delivers in July a largely unexpected rate cut |

On July 18th, Serbia was granted the opening of two more chapters in the EU accession path, Chapter 23 on the Judiciary and fundamental rights and Chapter 24 on freedom and security. Although the opening appears as a routine step in the EU candidacy process, this latest development is of high importance as this is the first enlargement event after the Brexit vote. In addition, these particular chapters are the most demanding and bear increased significance as they symbolize the basic values and principles of the EU. It also represents a concrete commitment by the EU and reinforces the credibility of the enlargement process, which is extremely important after the UK referendum result. Still, after the Brexit vote and the failed coup in Turkey, the geopolitical landscape is seen to be constantly reshuffling. Geopolitical factors are also manifested locally in the delay of the formation of the new government. Initial expectations of a swift outcome have been refuted, despite the overwhelming victory by the Progressives and PM Aleksandar Vucic. The government has to be voted in before the formal deadline on September 3rd. The new administration is widely anticipated to first and foremost show commitment to the continuation of the EU agenda and the IMF 3Y precautionary SBA arrangement, while at the same time try to keep close ties with Russia, whatever consistence these two objectives may have to each other. Direct Brexit spillover effects are likely to prove small, as Serbia has relatively thin economic ties with the UK; just 1.0% of imports and 1.7% of total exports relate to Britain, while foreign investments from the UK to Serbia in the 15 years of transition have been limited. The economy remains in good shape, despite some slowing in certain areas. The IMF recently upgraded its forecast on Serbia’s GDP growth for 2016 to 2.5%, mostly on solid investments from the previous period and a rise in net exports, along with the gradual recovery in personal spending. Industrial production has slowed down considerably in May – to 0.9%YoY down from double digit rates in previous months – but mostly as a consequence of low base effects in mining and energy production. Manufacturing, a larger contributor and a better gauge of business development, was up by 2.9%YoY in May and very solid (+6.7%YoY) for the 5M period. Foreign direct investments have also stalled of late, with the Jan-April figure amounting to just €459mn (-20%YoY), mostly due to the uncertainty instigated by the delay in government formation. Meanwhile, the budget execution in the first half of 2016 was better than anticipated, with a consolidated general government gap of just ca. €250mn on a cash basis, vs. a full year deficit target of €1.3bn. Tax and excise revenues exceeded projections by ca. €180-200mn, while the delay in lay-offs in SOEs contributed for savings of only ca. €50m y-t-d. As a result, the full year gap is not expected to exceed 3%. The burning issue of restructuring of the major state owned conglomerates, such as the EPS, Srbijagas and the Railroads, remains. At its MPC meeting in early July, the National Bank of Serbia took markets aback, slashing its key policy rate by 25bps to a new record low of 4.00%, confounding consensus expectations that it would stay put on its monetary policy. The cut snaps a 4-month streak of stable interest rates and follows a same size reduction in February. At that meeting, the NBS also narrowed the interest rate corridor relative to the key policy rate to ±1.50% from ±1.75%, noting that the amendment “will contribute to further stabilization of interest rates in the interbank money market, gradual reduction of the spread between the weighted average repo rate and the key policy rate, as well as to the strengthening of transmission through the interest rate channel”. Including June’s reduction the NBS has rendered a total of 775bps of monetary easing since May 2013. Behind its latest decision, the Central Bank cited low inflation pressures, ongoing fiscal consolidation and structural reforms implementation as well as reduced external imbalances. Possibly providing support to the NBS’s latest decision was the renewed deceleration in consumer inflation in June, where CPI came in at 0.3%YoY, marking the slowest rate of increase since January 2015 and moving further below the official tolerance target band of 4.0±1.5. In support of the aforementioned, low global commodity prices, a restrictive fiscal policy and a negative output gap all bode well for subdued inflation pressures. A positive IMF review assessment and a sovereign credit rating upgrade by Fitch, both in June, as well as scaled back expectations for Fed tightening ahead, also seem to have provided ammunition for one more rate cut – most likely the last – under the Bank’s current monetary easing cycle. Galatia Phoka (gphoka@eurobank.gr) +30 210 3718922 Ivan Radovic (Ivan.Radovic@eurobank.rs) +381 11 30 27 533 |

|

Source: National Authorities, EC, IMF, Eurobank Research |

FIGURE 25: Recovery in private consumption and wage growth continues (3MMA) Source: National Authorities, EC, IMF, Eurobank Research |

|

FIGURE 26: Inflation slides further below the NBS target in June Source: National Authorities, Eurobank Research |

|

|

FIGURE 27: Despite slowing due to base effects, growth in industrial production remained robust in Jan-May 2016 (3MMA YoY %) Source: National Authorities, EC, IMF, Eurobank Research |

FIGURE 28: NBS unexpectedly slashes key policy rate by 25bps to 4.00% Source: National Authorities, EC, IMF, Eurobank Research |

Special Focus: Brexit vote impact on the CESEE region

In this section, we look at the potential impact of Brexit on the Central Eastern and Southeastern Europe (CESEE) region. Firstly, we investigate the potential transmission channels of the shock, then we identify key socioeconomic issues arising from Brexit and then we delve into the financial markets’ reaction and the outlook going forward.

Our main thesis is that Brexit is a net negative from an economic growth and market sentiment standpoint, but not a catastrophic event for the region. In our view, the economic repercussions under the assumption of an orderly (and not protracted in duration) divorce from the EU are manageable. This is because the direct trade and FDI ties with UK and are modest, while there are no significant banking sector linkages. On the other hand, the broader region is significantly exposed to a euro area slowdown due to a UK exit, given the former’s role as a key trade partner and a major capital flow generator for the region. Furthermore, the long-term repercussions from a political economy standpoint could well prove far more important than the pure macroeconomic consequences.

The UK referendum outcome in favor of Brexit has sent shockwaves through CESEE financial markets. Yet, there is so far limited evidence to conceive it as a Lehman-type event as regards its potential ramifications for the region. Even though uncertainties remain high and there is still no formal date set for the beginning of Brexit negotiations, the region is now in a much better shape to face the incipient challenges compared to 2008. The good growth performance of most regional economies in the post-crisis era, the healing of earlier macroeconomic imbalances, the rebuilding of FX reserves and the implementation of structural reforms in the context of precautionary or regular EU-IMF stabilization programs have strengthened the relative position of the CESEE economies. In what follows, we examine a number of potential channels through which the Brexit vote could affect these economies.

- Trade channel: The UK is an important, though not an indispensable trade partner for the region. Trade linkages appear to be stronger for services than for goods. UK typically accounts for 3-4% of the total exports of goods and 6-9% of the total exports of services for the economies of the broad region. As a percentage of individual country GDP, the exposure is even lower. Exports of goods and services to UK account for between 1% and 2.5% of GDP for the SEE economies (Bulgaria, Romania and Serbia) and between 3% and 5% for Central Europe (Poland, Hungary and Czech Republic). In any case, there is no evidence at the moment, that trade ties would completely collapse and that a new bilateral trade agreement would replace EU membership.

|

Exports to UK 2014 |

Imports from UK 2014 |

|||

|

Services (%GDP) |

Goods (%GDP) |

Services (%GDP) |

Goods (%GDP) |

|

|

Bulgaria |

1.3% |

1.1% |

0.6% |

1.0% |

|

Czech Republic |

0.7% |

4.3% |

0.5% |

1.9% |

|

Hungary |

1.3% |

3.0% |

0.8% |

1.3% |

|

Poland |

0.6% |

2.6% |

0.5% |

1.1% |

|

Romania |

0.7% |

1.4% |

0.5% |

0.9% |

|

Serbia |

0.8% |

0.3% |

0.4% |

0.5% |

|

Turkey |

0.3% |

1.1% |

0.3% |

0.9% |

Source: Eurostat, National Authorities, Eurobank Research

- FDI flows & banking sector: First, There are no significant direct financial services linkages between UK and the region. In addition, FDI ties are modest. The economies of our focus – net recipients of FDI inflows from UK- are ranked relatively low in the scale of FDI stock, way below the EU average. As such, Brexit would not necessarily result in a dry-up of FDI inflows in the region.

FDI stock (% of individual country GDP, 2014)

Source: ONS, Eurostat, Eurobank Research

- Migration & remittances: Migrants to the UK generally correspond to a small share of the total CESEE population. With the exception of Cyprus, Poland has the highest number of migrants to the UK with a population share of approximately 1.8%, while other countries in the region feature a share of less than 1% of their total population. Linkages between the CESEE economies and the UK in terms of remittances also appear to be rather limited, generally not exceeding 0.3% of a country’s GDP. It is also worth noting that, even assuming its decrease as a result of Brexit, such a relatively insignificant source of income for the CESEE region is unlikely to be fully eliminated. Indeed it is rather unrealistic to assume that all migrants will be forced to leave the UK in the event of the latter exiting the EU. And, for those who will eventually decide to leave it is reasonable to assume that some of them may relocate to other EU economies, thus continuing to send remittances back home. A more immediate risk for remittances to the CESEE region may relate to the sterling’s weakening after the Brexit vote. Yet, any incipient impact is likely to be manageable, given that the amount of remittances towards the region is relatively low in terms of GDP.

Migrants in the UK as percentage of origin country population (2015, %)

Source: United Nations, Eurostat, Eurobank Research

Net remittances from the UK (2015, % of GDP)

Source: IMF, World Bank, Eurobank Research

- EU Funds: CESEE economies are major recipients of EU structural and cohesion funds, with total EU budget commitments for the period 2014-2020 amounting to €433.3bn. Poland is the primary recipient of EU funding, scheduled to receive €86bn over the said time span, with Italy posing as the runner up, due to receive €42.7bn. Given that UK is among the largest contributors to EU budget, this appears to be one of the biggest concerns over the impact of Brexit on the CESEE region. A renegotiation of the allocation of EU funding for 2014-2020 appears to be unavoidable after the Brexit vote. However, if there is no change in the designated funds for the period 2014-2020, any Brexit-related impact would be felt only after 2020.

EU ESI Funds (per recipient country, mn EUR)

Source: European Commission, Eurostat

- EU Enlargement: Brexit could potentially have some important political economy ramifications for the region. First, it could put a temporary break on EU enlargement and future euro area membership applications. Most of the economies of our focus are relatively new EU members having the obligation (under the Accession Treaty of 2004) to become euro area members if convergence criteria are met. Some of the countries have had a tentative target of euro area accession (e.g. Romania in 2019) or were about to set a new formal target, which may now be pushed back.

- Domestic Politics: The Brexit vote may strengthen Eurosceptic sentiment in the region, leading to an increase of the electoral power of anti-systemic political parties. Yet, the impact of the vote is unlikely to be uniform across the region. Although the governments of Romania and Bulgaria are in favor of more EU integration, this is not necessarily the case for the governments of the so called Visegrad group (Poland, Czech Republic, Slovakia and Hungary). In particular, the leaderships of Poland and Hungary have lately been particularly vocal in their criticism towards EU institutions. The Brexit vote may complicate things further and, as best case scenario, push these countries to deepen their co-ordination on important economic and geostrategic issues at the EU level. That is, especially taking into account that the UK has often been a valuable political ally of these countries (and an advocate of their petitions) in the EU decision making process. Yet, given that both Poland and Hungary benefit from sizeable EU funding, it is rather unlikely that an exit-referendum would be initiated by these countries in the foreseeable future. In a more reassuring note, the Brexit vote occurred at a time when the near-term political risk calendar in the region is relatively light, with a number of important events having already been taken place (e.g. parliamentary elections in Serbia and Cyprus, local elections in Romania). Yet, parliamentary elections in Romania and Presidential elections in Bulgaria are pending (November 2016 and October 2016, respectively). Additionally, a government has yet to be formed in Serbia, though general elections are already behind us. According to recent comments by Prime Minister Alexander Vucic, a new administration is expected to be announced in early July. The winner of the polls, the ruling Serbian Progressive Party (SNS), achieved a parliamentary majority to form a single party government. However, it appears to be seeking a stronger mandate via a coalition alliance. Among the parties that entered parliament this year are the far-right nationalist Serbian Radical Party (SRS) which returned to the National Assembly after a four-year absence and the right-wing Serbian Movement Dveri which is a newcomer in Parliament. In view of the recent rise in popularity of right wing/nationalist parties in Serbia, the Brexit vote may tip the scale towards a more Eurosceptic government.

Ioannis Gkionis (igkionis@eurobank.gr)

(+30) 210 337 1225

Galatia Phoka (gphoka@eurobank.gr)

(+30) 210 371 8922

Exports of services to UK vs Rest of the World (2014)

Source: Eurostat, National Statistic ,Eurobank Research

*EU-27: EU28 without UK

Source: Eurostat, National Statistic ,Eurobank Research

*EU-27: EU28 without UK

Imports of services from UK vs Rest of the World (2014)

Source: Eurostat, National Statistics,Eurobank Research

*EU-27: EU28 without UK

Source: Eurostat, National Statistics,Eurobank Research

*EU-27: EU28 without UK

Exports of goods to UK vs Rest of the World (2014)

Source: Eurostat, National Statistic,Eurobank Research

*EU-27: EU28 without UK

Source: Eurostat, National Statistic,Eurobank Research

*EU-27: EU28 without UK

Imports of goods from UK vs Rest of the World (2014)

Source: Eurostat, National Statistic ,Eurobank Research

*EU-27: EU28 without UK

Source: Eurostat, National Statistic ,Eurobank Research

*EU-27: EU28 without UK

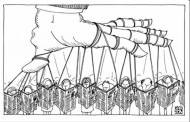

The Voting Paradox and the result of the recent Brexit referendum

The 51.89% of the voters decided to support the exit of the UK from the European Union. The current article tries to answer the following questions:

- Why the turnout was so high that reached the 72.2%, with more people turning out to vote than in last year’s general election? Why did 30 million people turn out vote?

- Why was Brexit so close to Bremain?

The Voting Paradox may be able to describe a part of this historical turnout. The paradox describes a situation where there are two candidates (1 and 2) who offer 2 different payoffs (benefits) (E1 and E2, respectively) with E1>E2. The net expected payoff of the voting is B=E1-E2. A cost (C) for each voter to vote also exists. Thus, if a voter for Candidate 1 believes that Candidate 1 will win with a significant difference in the number of votes, then she is not going to participate in the voting because her marginal payoff is lower compared with the cost of voting. In the same way, if a voter of Candidate 1 believes that Candidate 2 is going to win with a significant difference in the number of votes, she will not vote, avoiding the cost of voting. The voter is going to participate in the voting only if her marginal “profit” P*B-C>0, where P is the probability that the voter under question is the marginal voter that he will change the outcome in favor of his preferred candidate. The probability P is negatively related to the number of voters’ turnout and positively related to the uncertainty of the final result from the voter’s perspective.

Using the above and the fact that the turnout of the referendum was at 72.2% we can conclude that the average potential voter‘s marginal “profit” was positive enough for her to participate in the vote. If we assume that the probability P is the same for both groups of voters then the Brexit voters had been convinced, by their platform, that their net expected payoff of voting (B1) was greater than that of the Bremain voter (B2). This might be the reason of why ex-post there is such a disappointment in the UK over the Bremain’s campaign that failed to convince the respective supporters to participate in the vote (i.e. it failed to increase their net expected payoff of voting). In other words, despite the high turnout, the uncertainty about the outcome of the referendum induced each Bremain supporter to vote as being the marginal voter while this was not true for the BREMAIN case.

Grigoris Katsavos (v-gkatsavos@eurobank.gr)

+210-3371207

Eurobank Ergasias S.A, 8 Othonos Str, 105 57 Athens, tel: +30 210 33 37 000, fax: +30 210 33 37 190, email: EurobankGlobalMarketsResearch@eurobank.gr

Eurobank Economic Analysis and Financial Markets Research

More research editions available at http://www.eurobank.gr/research

- Daily Overview of Global markets & the SEE Region: Daily overview of key macro & market developments in Greece, regional economies & global markets

- Greece Macro Monitor: Periodic publication on the latest economic & market developments in Greece

- Regional Economics & Market Strategy Monthly: Monthly edition on economic & market developments in the region

- Global Economy & Markets Monthly: Monthly review of the international economy and financial markets

Subscribe electronically at http://www.eurobank.gr/research

Follow us on twitter: http://twitter.com/Eurobank

Arkadia Konstantopoulou: Research Assistant arkonstantopoulou@eurobank.gr + 30 210 33 71 224

Paraskevi Petropoulou: G10 Markets Analyst

ppetropoulou@eurobank.gr, + 30 210 37 18 991

Galatia Phoka: Research Economist

gphoka@eurobank.gr, + 30 210 37 18 922

Dr. Theodoros Stamatiou: Senior Economist

tstamatiou@eurobank.gr, + 30 210 3371228

Eurobank Economic Analysis and Financial Markets Research

Dr. Platon Monokroussos: Group Chief Economist

pmonokrousos@eurobank.gr, + 30 210 37 18 903

Dr. Tassos Anastasatos: Deputy Chief Economist

tanastasatos@eurobank.gr, + 30 210 33 71 178

Anna Dimitriadou: Economic Analyst

andimitriadou@eurobank.gr, + 30 210 3718 793

Ioannis Gkionis: Research Economist

igkionis@eurobank.gr + 30 210 33 71 225

Dr. Stylianos Gogos: Economic Analyst

sgogos@eurobank.gr + 30 210 33 71 226

Olga Kosma: Economic Analyst

okosma@eurobank.gr + 30 210 33 71 227

Research Team

Eurobank Ergasias S.A, 8 Othonos Str, 105 57 Athens, tel: +30 210 33 37 000, fax: +30 210 33 37 190, email: EurobankGlobalMarketsResearch@eurobank.gr

Eurobank Economic Analysis and Financial Markets Research

More research editions available at http://www.eurobank.gr/research

- Daily Overview of Global markets & the SEE Region: Daily overview of key macro & market developments in Greece, regional economies & global markets

- Greece Macro Monitor: Periodic publication on the latest economic & market developments in Greece

- Regional Economics & Market Strategy Monthly: Monthly edition on economic & market developments in the region

- Global Economy & Markets Monthly: Monthly review of the international economy and financial markets

Subscribe electronically at http://www.eurobank.gr/research

Follow us on twitter: http://twitter.com/Eurobank

Arkadia Konstantopoulou: Research Assistant arkonstantopoulou@eurobank.gr + 30 210 33 71 224

Paraskevi Petropoulou: G10 Markets Analyst

ppetropoulou@eurobank.gr, + 30 210 37 18 991

Galatia Phoka: Research Economist

gphoka@eurobank.gr, + 30 210 37 18 922

Dr. Theodoros Stamatiou: Senior Economist

tstamatiou@eurobank.gr, + 30 210 3371228

Eurobank Economic Analysis and Financial Markets Research

Dr. Platon Monokroussos: Group Chief Economist

pmonokrousos@eurobank.gr, + 30 210 37 18 903

Dr. Tassos Anastasatos: Deputy Chief Economist

tanastasatos@eurobank.gr, + 30 210 33 71 178

Anna Dimitriadou: Economic Analyst

andimitriadou@eurobank.gr, + 30 210 3718 793

Ioannis Gkionis: Research Economist

igkionis@eurobank.gr + 30 210 33 71 225

Dr. Stylianos Gogos: Economic Analyst

sgogos@eurobank.gr + 30 210 33 71 226

Olga Kosma: Economic Analyst

okosma@eurobank.gr + 30 210 33 71 227

Research Team